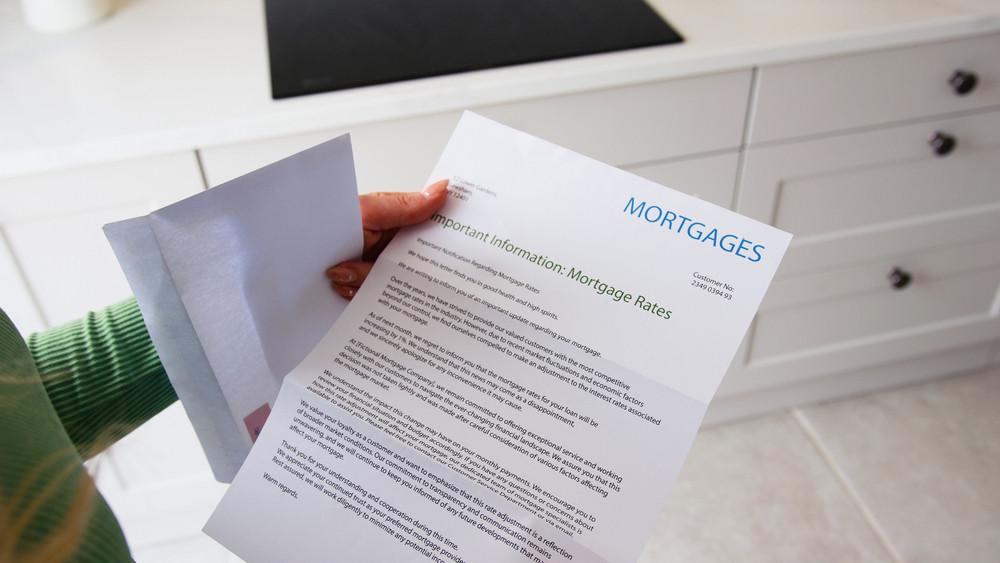

Purchasing a home is often one of the biggest financial steps in a person’s life. Understanding mortgage loans is crucial for first-time homebuyers or anyone looking into home financing options. This guide outlines the basics of mortgage loans, breaking down complex terms and concepts, and helping you make informed decisions about choosing the right mortgage for your financial situation.

1. What Is a Mortgage Loan?

To start, it’s essential to know what a mortgage loan is. It is a secured loan specifically used for purchasing a property where the property itself serves as collateral. This means if payments are not made on time, the lender could foreclose on the home. Mortgages are typically long-term loans, with terms usually ranging from 15 to 30 years, allowing buyers to manage substantial investments without having to pay the entire cost upfront.

2. What Types of Mortgages Are There?

One of the most common types of mortgages is a fixed-rate mortgage, where the interest rate remains unchanged throughout the life of the loan. According to Gitnux, nearly 70% of mortgage holders have fixed-rate home loans, offering stability and predictability in monthly payments. This is particularly beneficial for budgeting purposes, as you know your repayment amount will remain constant, regardless of market fluctuations.

3. What Are the Pros and Cons?

Adjustable-rate mortgages (ARMs) offer a fluctuating interest rate. Initially, they may start with a lower rate compared to fixed-rate mortgages, but the rate can increase or decrease based on the index it is tied to. While ARMs can be risky due to potential rate hikes, they might suit buyers planning to sell or refinance before the rates adjust. Carefully considering the pros and cons of each mortgage type, and how it fits your financial strategy, can help determine the best option for you.

Understanding the intricacies of a mortgage loan might seem daunting, but taking the time to explore your options can pay off significantly. From determining whether a fixed-rate or adjustable-rate mortgage best suits your needs to understanding the long-term implications of your choice, being informed is key. As you delve into home financing, keep in mind the importance of selecting a mortgage that aligns with your financial goals and lifestyle, setting the stage for a successful and stress-free homeownership experience. If you want to know more about mortgage loans, call RCLF today!