RCLF Home Purchase Services

Congratulations on taking your first step towards homeownership! Our Home Purchase Advisors offer credit and financial counseling to assist you in becoming mortgage ready. Our Advisors look forward to getting you on the right path to sustainable and responsible homeownership.

Start the Home Purchase Process

To begin the process of purchasing a home with RCLF, click below and fill out the Home Purchase Inquiry form.

Home Purchase Loans

- Borrowers receive a fixed-rate mortgage offering stable and affordable monthly payments

- FHA, Fannie Mae, VA and USDA loans are available to qualified borrowers

- RCLF InHouse Program

- 1-4 unit owner occupied purchase financing available

- Condo purchase financing available

One-On-One Financial Counseling

Our expert HUD-certified housing counselors provide personalized, one-on-one financial guidance & counseling at no cost to you to help you become mortgage ready and build a successful financial future.

Section 8 Home Purchase Program

In this program, your Section 8 voucher may be used toward the monthly mortgage payment after a home purchase. If you are currently in a Section 8 rental, you must be approved through Section 8 to transfer your current rental voucher to a home ownership voucher.

RCLF InHouse Program

Program Features:

- Up to 105% financing with no loan limit

- No monthly mortgage insurance

- Student loans in deferment? That’s okay!

- No income restrictions

- Not just for first-time buyers

- Condos allowed

- Seller concessions up to 6%

- Minimum credit score: 650

- Can be combined with eligible down payment assistance

- Must be for a primary residence

- One (1) month reserves required

Down Payment Assistance Programs

Renaissance Community Loan Fund offers Down Payment Assistance (DPA) to qualified borrowers. In order to qualify for DPA available through Renaissance, you will need to utilize our in-house mortgage team to process your loan. At this time we are unable to offer only DPA in partnership with another lender’s loan. DPA is subject to availability.

*See below for our current DPA Programs

**This program is currently only available for Alabama residents

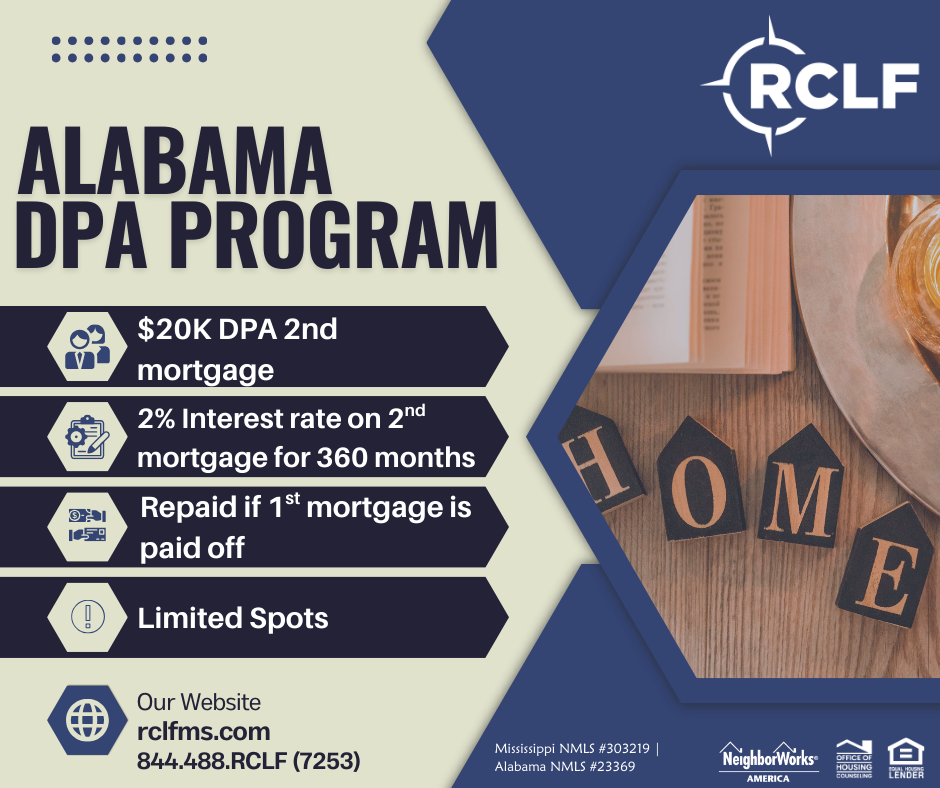

**AL DPA Program

Program Features:

- $20,000 DPA 2nd Mortgage

- 2% Interest rate for 360 months

- Repaid if 1st mortgage is paid off

- Limited spots

*These programs are currently only available for Mississippi residents

*EASY8 Program

Easy8 offers $8,000 in down payment assistance and closing costs with a competitive interest rate. Let us make your dream of homeownership a reality.

Program Features:

- 30-year fixed rate mortgage (rate subject to change)

- FHA insured, VA, Rural Development, & Fannie Mae/Freddie Mac Loans

- No liquid asset limit

- $8,000 with 0% interest

- Due-on-sale payable to MHC at refinance, non-owner occupied, or 1st mortgage paid in full

- Can be used towards down payment, closing costs, or pre-paids

Eligibility:

- First-time homebuyers or persons who have not owned a principal interest in a residence in the past 3 years

- Certain areas of the state, called “Target Areas” and veterans are exempt from the “first-time homebuyer” rule

- Households who are within the income guidelines for the county in which they purchase a home

- Credit qualify with a participating lender

- Property must be owner-occupied & principal residence

- Homebuyer education required

*TRUSTY10 Program

Need a program you can trust? Trusty10 offers $10,000 in down payment assistance and closing costs wit h a competitive interest rate. See if this program is right for you.

Program Features:

- 30-year fixed rate mortgage (rate subject to change)

- FHA, VA, Rural Development and Fannie Mae/Freddie Mac loans

- No liquid asset limit

- $10,000 down payment as a 2nd mortgage

- 2nd mortgage has a 2% interest rate

- 15-year loan

- Can be used towards down payment, closing costs, or pre-pa ids

Eligibility:

- First-time homebuyers or persons who have not owned a principal interest in a residence in the past 3 years

- Certain areas of the state, called “Target Areas” and veterans are exempt from the “first-time homebuyer” rule

- Households who are within the income guidelines for the county in which they purchase a home

- Credit qualify with a participating lender

- Property must be owner-occupied & principal residence

- Homebuyer education required

*Smart7 Mortgage Program

The Smart7 Mortgage Program can give you the funds you need to purchase your first home or move up to your next one. As a participating lender with MS Home Corporation, Renaissance can offer competitive interest rates with $7,000 in down payment assistance as a second mortgage.

Program Features:

- 30-year fixed rate mortgage (rate subject to change)

- FHA, VA, Rural Development and Fannie Mae/Freddie Mac loans

- No liquid asset limit

- $7,000 with 0% interest due upon sell

- Principal due upon property sale, refinance, non-owner occupied, or loan maturity

- Can be used towards down payment, closing costs, or pre-paids

- Purchase price cannot exceed $398,310

Eligibility:

- Must serve as your primary residence

- Household income cannot exceed $132,770

- Must be a legal resident of the United States

- Credit score is based on service guidelines

- No first-time homebuyer requirements

- Homebuyer education required

Homebuyer Equity Leverage Partnership (HELP) Program

The HELP Program funding is based on availability as set by Federal Home Loan Bank Dallas.

HELP is a program administered by Federal Home Loan Bank Dallas. Through member institutions such as Renaissance, HELP assists low-income qualified, first-time homebuyers with down payment assistance and closing costs. HELP has limited funds that are available on a first-come, first-served basis to qualified homebuyers.

Homebuyer Requirements:

- HELP funds may not exceed $20,000 per homebuyer.

- Household income must not exceed 80 percent of the area median income.

- Homebuyers are required to complete a Homebuyer Education Course.

- Homebuyers must contribute $500 of their own funds toward the required down payment or closing costs.

- Homebuyers cannot currently own a home.

- Home must be your principle residence.

- Homebuyers cannot receive any cash back at closing.

- Homebuyers are required to sign a five-year retention agreement.

If you are unable to submit this form online, please contact us at (228) 896-3386 for assistance.

In This Section

Use our Mortgage Resource Center to learn more about the homebuying process.

Home Purchase Success Stories

Read about our inspiring clients who worked with RCLF to purchase the home of their dreams!

Resources

Mortgage Resource Center

Business Resource Center

Classes